Card Personalization Validation (CPV)

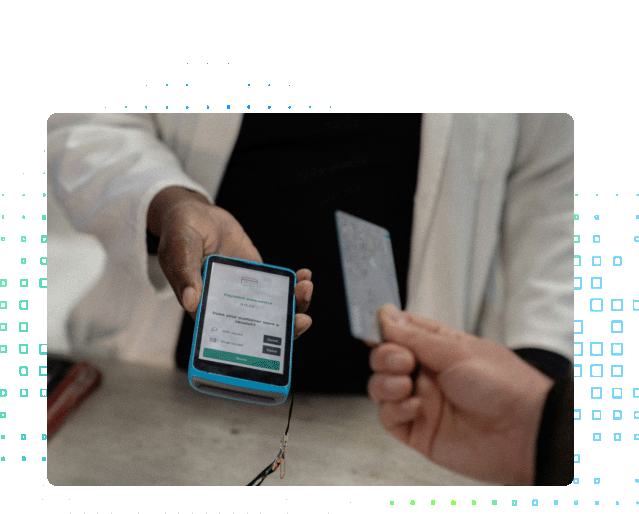

The goal of CPV is to help ensure that every chip device bearing a Mastercard application complies with the latest Mastercard card personalization requirements and will be correctly accepted in payment acceptance devices.

CPV is the procedure that affects or their certified agencies must follow before publishing a chip product supporting an EMV contact interface, an EMV contactless interface or both and applying a Mastercard brand mark.

Card personalization can be done for various set of users involving for government department’s identities such as PAN, Aadhar, ESIC, healthcare services subscribers or members under different categories Including disbenefit and credit cards from different banks, loyalty cards, prepaid cards, identification cards for private organizations like corporations, manufacturing plants, schools, etc.

A card can be tracked with a special law, bar code, chip, QR code, RFID or through a numeric serialized number (generated by the system randomly through a pin creation tool) to track the user against whom the card is issued. A banking services provider can customize the card for each set of clients, categorically for services like debit card, credit card.